utah non food tax rate

January 1 2022 current. With local taxes the total sales tax rate is between 6100 and 9050.

States With The Highest Lowest Tax Rates

93 rows This page lists the various sales use tax rates effective throughout Utah.

. The state rate is 485. Utah UT Sales Tax Rates by City. Local sale tax is collected at county and city levels and it ranges from a.

Utah has recent rate. It disproportionately hurts low-income Utahns and. 1 entity and 2 area.

The state sales tax rate in Utah is 4850. As of this writing groceries are taxed statewide in Utah at a reduced rate of 3. A group of entity rates make up the area rate.

Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335. Average Sales Tax With Local. Exact tax amount may vary for different items.

The Utah state sales tax rate is 595 and the average UT sales tax after. What is the non food tax in Utah. The Utah UT state sales tax rate is 47.

January 1 2018 December 31 2021. Depending on local jurisdictions the total tax rate can be as high as 87. 2022 Utah state sales tax.

The Utah state sales tax rate is 595. Utah Sales Tax Rates. There are two types of tax rates.

The Utah income tax has one tax bracket with a maximum marginal income tax of 495 as of 2022. The area rate becomes the final tax rate charged by counties. 46sqgbkziubbqm Exact tax amount may vary for different items.

Tax years prior to 2008. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. In Utah sales taxes are applied at both the local and state level.

Detailed Utah state income tax rates and brackets are available on this page. But Utahs existing tax on food even at its lower rate of 175 compared to the full 485 sales tax rate is still wrong. January 1 2008 December 31 2017.

The state provides a guidance page with plenty of examples on what is and what is not. January 1 2022 current. State sales tax is 470 percent.

Any product or service exempt from Utah sales tax. 271 rows Utah Sales Tax. Utah specifies that prepared food is considered ready to eat or sold with utensils.

Property Taxes Went Up In These Utah Cities And Towns

Sales Taxes In The United States Wikipedia

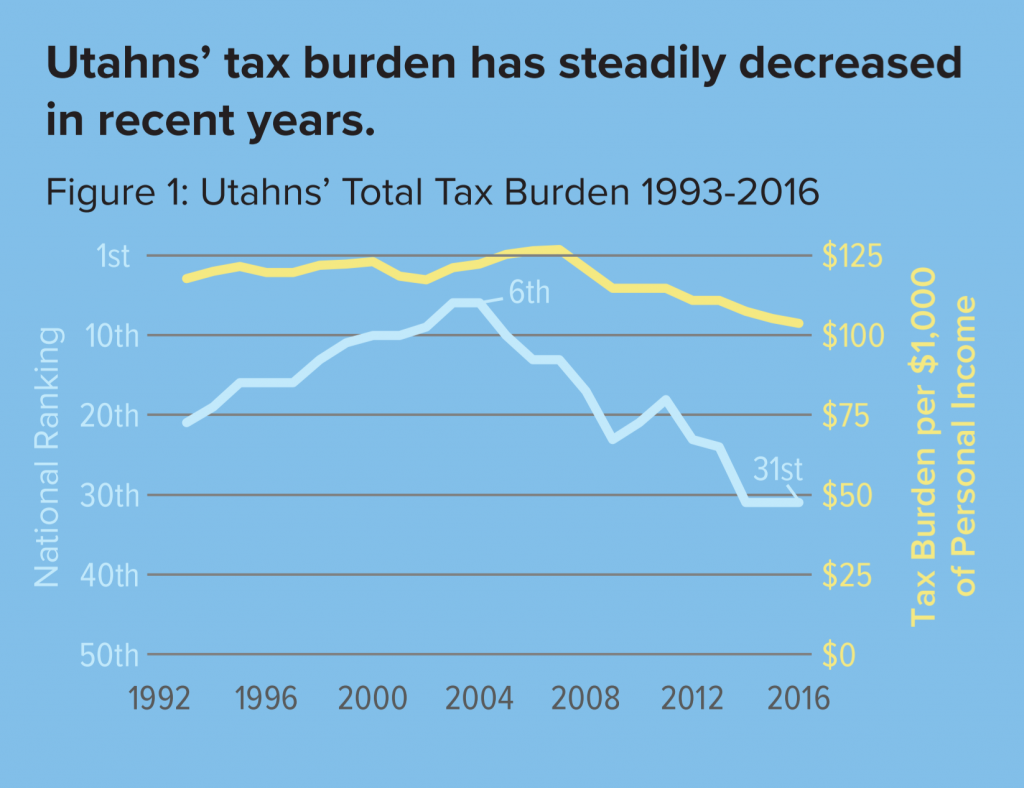

Utah Priorities 2020 Utah Priority No 2 State Taxes And Spending Utah Foundation

Will Utah Repeal Its State Sales Tax On Food Deseret News

Utah Sales Tax Rate Rates Calculator Avalara

Utah Income Tax Calculator Smartasset

Utah Sales Tax A Policymakers Guide To Modernizing Utah S Sales Tax

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

2020 State Tax Trends To Watch For Tax Foundation

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

2022 Property Taxes By State Report Propertyshark

Sales Taxes In The United States Wikipedia

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Property Valuation Notice Utah County Clerk Auditor

Utah Sales Tax A Policymakers Guide To Modernizing Utah S Sales Tax